Client Testimonials

I truly appreciated the hands-on customer support received throughout the process from implementation to completion. I am thankful for the dedication, attention to detail, & ultimately great survey data I received from working with CloudResearch.

Tayah Wozniak

MPH of Chapman University

We had such a great — and FAST — experience with implementing our survey on Prime Panels! We're raving to our colleagues about this process and over the next few months, we plan to conduct even more surveys with you!

Zoelene Hill

New York University

I found your services to be very high quality and extremely useful. Your product support is also EXCELLENT. All questions have been answered and you have actually been patient enough to teach me.

Guillermo Jimenez

Professor of International Trade & Fashion Law

Fashion Institute of Technology

Even with several rigorous exclusions, we are keeping, on average, 98.5% of our collected participants with CR recommended settings. So your recent changes over the last year have definitely worked!

Alan Lambert

Washington University

CloudResearch is SO MUCH BETTER than native mTurk. I cannot tell you how much it has improved my work life!

Kay Siefken

NameStormers

CloudResearch panels make it easy to target specific groups without the added complexity of screening unselected web-based populations. I've found that CloudResearch panels provide a fast and affordable source for high quality data.

Aaron Leea

Ole Miss University

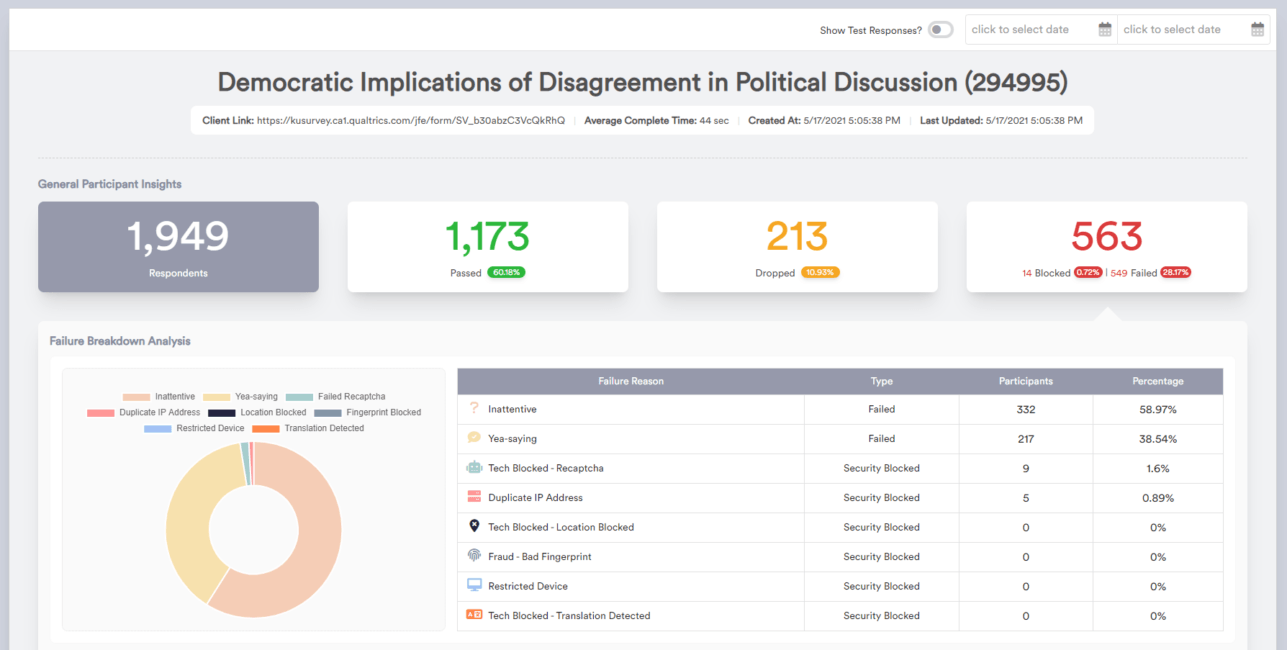

I'm really impressed by the high data quality your filter provides, participants who correctly answer our control question jumps from 55% (without your filter) to 90%! I suspect there are a lot of bots on MTurk recently that we avoid by using your filter.

Martin Hedesstrom

University of Gothenburg

I've used Connect quite a bit, and I've found it to be a very good platform! It's easy to use and the data are quite good when looking at open-ended responses and attention checks. I've also collected data that targeted Republicans and Democrats, and that worked well too! Thank you all for your work on this platform!

Crystal Hoyt

Professor of Leadership Studies and Psychology and the Colonel Leo K. & Gaylee Thorsness Endowed Chair in Ethical Leadership

University of Richmond

Connect combines best-in-class researcher tools with an outstanding panel of attentive and reliable survey respondents. The team's customer support is also exceptional. The new Teams feature makes it easy for collaborators on joint projects to field surveys without complicated workarounds or compromising the security of your accounts. I have integrated it into my workflow on all of my new projects on Connect.

Brendan Nyhan

Freedman Presidential Professor in the Department of Government

Darthmouth University

The Connect platform has been a game changer for me! The Teams feature saves quite a bit of work, I highly recommend it!

Jeff Galak

Associate Professor of Marketing

Carnegie Mellon University

Connect has the highest data quality I've ever gotten! I'm not sure how you do it, but it's incredible.

Chase Herndon

Social Psychology PhD Candidate

Kansas State University

This platform is great, it's super fast and almost everyone passes attention checks!

Dr. Grant E. Donnelly

Department of Marketing & Logistics Sustainability Institute

Ohio State University

The only adjective I can offer is Spectacular! We got full responses on each of the surveys we sent out, and the data sets are wonderfully rich! I would recommend CloudResearch to anyone seeking good, effective survey data. I could not imagine a better experience.

Christopher Puto

Professor Emeritus

Spring Hill College

CloudResearch facilitated an easy and efficient process to collect high-quality data and help us reach our target audience. I can't wait to work with CloudResearch again on future research projects!

Beth Sundstrom

Communication Director, Executive Committee, SC Immunization Coalition and Associate Professor, Communication and Public Health

College of Charleston

CloudResearch provides access to a huge range of participants, with the option of tailoring samples, for an excellent price. The CloudResearch team is extremely responsive and supportive, helping my research team find the best strategies for our projects. We have worked on many projects already with CloudResearch and are looking forward to many more!

Julie J. Exline

Professor

Case Western Reserve University

CloudResearch was attentive and easy to work with. They truly care about data quality and will make sure you attain all participants necessary for your study. Not to mention, unlike other third party panels, CloudResearch is reasonably priced! I will definitely be using them again.

Amanda Harryman

Doctoral Student

Alliant International University

I really appreciated how attentive CloudResearch's customer service was. I was impressed by their ability to reach a marginalized population in a relatively short time frame. I will definitely use them for future projects!

Jessamyn Bowling

Associate Professor, Department of Public Health

UNC Charlotte

I used CloudResearch to recruit U.S. police officers, who are a hard-to-reach population. My Project Manager helped me set up data quality checks, quickly answered my questions, and provided regular updates throughout the recruitment process. I wouldn't have been able to recruit police officers as easily or as quickly without CloudResearch.

Jean Cabell

Doctoral Student

University of Nevada, Reno

CloudResearch is our go-to resource for reaching the specific segments we require in our research activities. They share our commitment to data integrity by carefully screening targeted populations with rigorous quality and attention checks. The project management team excels in identifying and supporting our needs. As our business continues to expand, so does our research--CloudResearch has been an integral part in accelerating that process.

Christina Norton

Director, Resource Development

Revenue Management Solutions

The CloudResearch platform has been quite a lucrative asset to our data collection pipeline. The timely response by their support team and the platform's robust screening measures (e.g., Data Quality tool) have been immensely helpful in garnering rich data.

Praveen Suthaharan

Doctoral University

Yale University

We used CloudResearch to collect longitudinal data on a battery of cognitive ability tests which required sustained, effortful attention for over 75 minutes. The participants we sampled provided more complete, high-quality data than our traditional sample sources and at a lower cost. Our partnership allowed us to meet our study goals while maintaining the highest levels of data quality.

Kevin Field

Research Director

The Ball Foundation

I've used Connect since it first came around, and it has become my first stop for data collection. The interface is seamless, the pricing is fair, and the quality of participants is on par with–if not better than other online samples I use. The data get collected very quickly, and the team behind the website are very responsive and helpful. Five Stars all around!

Jacob Teeny

Assistant Professor of Marketing

Northwestern University